Some Canadian churches being hit by tax loophole

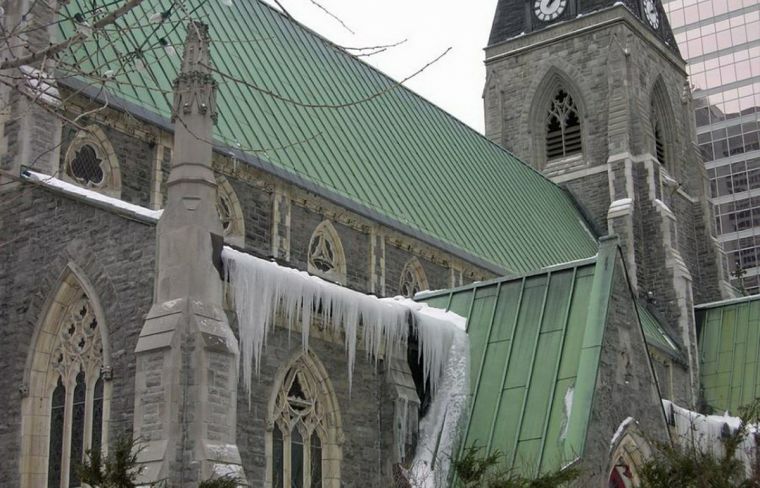

Some churches in Montreal, Canada, are falling foul of a loophole in tax law which means they are being charged an increasing amount.

Churches in Montreal are except from paying council tax. However, it's reported that officials now say only rooms which are used for worship are exempt.

That means other spaces are liable for tax – even if they're being used for good works in the community such as food banks.

A report in the Independent claims that if a church building closes down for worship, it is immediately liable for increased tax rates – meaning it has to be sold quickly.

'Already our churches are in danger, they're having a number of financial problems and this is a further low blow,' Montreal Councillor Peter McQueen told CTV.

'If we don't do something you're going to see churches closed, churches possibly torn down, heaven forbid, certainly converted away from community use.'

The move has pleased some campaigners. One blogger wrote, 'Bottom line: Montreal is getting it right. Taxpayers should not be in the business of subsidizing religious superstition. It's time to tax the church.'

Montreal City Council hasn't yet commented on the issue, but its website says, 'Montréal's City Council levies a variable rate tax on all properties situated within the city. Rates depend on property category.'