Just as commerce took over the language of the Church, and men in suits drew up "mission plans" to "evangelise" their product, the Church is taking on mammon with a new gospel inspired by the financial background of the Archbishop of Canterbury.

Disciples on the ground speak of "cashing out" the Bible to grow "faith capital" on the streets of Britain.

This week he has, in effect, overturned the tables of the money lenders. But that is not how it is being described.

The Archbishop's new #toyourcredit initiative, aimed at creating a fairer banking system to ensure that everyone has access to essential financial services, is starting from the bottom up.

Key to his attempt to reform the entire way debt works in Britian is a nationwide programme to help teach children how to save and manage money.

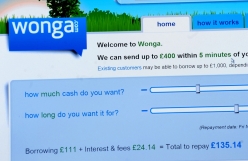

Meanwhile, many payday lenders are facing an uncertain future because of new caps and charges to be imposed by the Financial Conduct Authority in January, preventing them from charging more than 0.8 per cent interest per day or getting back paid back more than twice the value of the original loan in interest charges.

There are many passages throughout the Bible that can be cash-tilled for God. Verses in Deuteronomy, Exodus and the Psalms prohibit charging interest on loans, and also recommend a seven-year debt write-off period. In Luke's Gospel, Jesus said: "Love your enemies, do good to them, and lend to them without expecting to get anything back."

Because it is impractical to impose such conditions in today's financial markets, there has been a tendency among some clergy and pastors to write off these passages, as if they are bad debt that cannot be met in the spiritual markets of the 21st century. Archbishop Welby has put them back on the debit sheet, with interest.

As a priest with unprecedented experience in finance, from his career in the oil industry, Archbishop Welby's approach is not so much conservative Christian as post-liberal. It is wholly radical, comparable to that of Pope Francis. These passages are invoked, but interpreted in a way suited for the times. Interest therefore can be charged, but not in such a way that it damages the borrower.

As with women priests and the controversies over homosexuality, he has cut a swathe through Christian equivocation, and is empowering his flock in new ways that are helping to change not just the language, but the shape of the Church and even the financial services sector itself in Britain.

By appointing Sir Hector Sants, former head of the Financial Services Authority, to head the task group behind the #toyourcredit initiative, he has given muscle to his imagination. The Archbishop's dream of 16,000 parish churches helping members of the public find a different way to save and borrow money, through credit unions, is being realised in three pilot projects, the second of which, in Hackney in east London, was launched this week. Hundreds have already signed up and the aim is to grow this to hundreds of thousands.

They are the work of the Church Credit Champions Network launched this summer by the Centre for Theology and Community, based in east London, and are already reaching out to parishioners and others in local neighbourhoods who need or can offer help, enabling them to become borrowers or savers with the local high street credit union that in most places already exists. Small paying-in points can and are being set up, in churches with the resources to manage this, often running for a few hours a week alongside existing food banks.

Dr Angus Ritchie, the director of the Centre for Theology and Community, quoted from Psalms 112, "Good will come to him who is generous and lends freely," and 15, praising the good man "who lends money to the poor without interest." Dr Ritchie explained to Christian Today the significance of having Archbishop Welby in office at this point.

"It is very helpful to have a clear lead on the issue and to have that in a way that is delivering action. For him, it is clearly rooted in what Christians believe, rooted in Christian faith."

Christian teaching and Scripture understand wealth, possession and the material world as gifts from God, things that ultimately are not ours. "The purpose of the gifts is to help us grow in good relationship between God and neighbour," said Dr Ritchie. How people interact with one another at the level of economics as well as human relationships is at the core of ethical thought around the issue.

Debt and the forgiveness of debt is central to the New Testament, he said. "The Church is saying there are situations where lending money at interest just reflects the fact that there is a cost to lending. But particular types of lending are exploitative."

When Archbishop Welby announced in July last year that he wished to take on payday lenders and loan sharks by offering an alternative, through the Church's unrivalled parish network, many scoffed. They knew it would not be possible to set up hundreds of new credit unions. But that was never the plan.

The aim was simply to rebalance the books, by putting the Gospel in the ledger, a sort of supernatural prophet approach versus supra-profit. The banks probably don't yet know what's blessed them. And Welby meanwhile is laughing all the way to the Church.